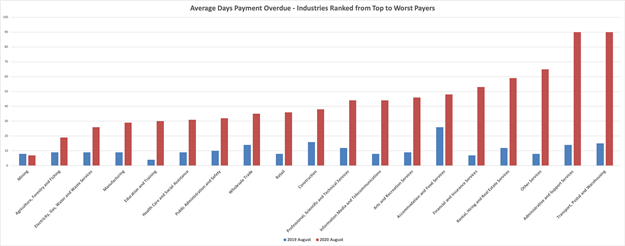

CreditorWatch graph highlights transport, postal and warehousing issues during pandemic

Industry’s concerns on late payment times are vindicated with a report highlighting the deteriorating trend in recent months.

Credit reporting agency CreditorWatch lays bare the stark rise of the impact in the transport, postal and warehousing (TPW) industry.

The sector’s late-payment average of 15 days in August 2019 has been eclipsed a year later, jumping to 90 days in August 2020 – a 500 per cent increase in the midst of the Covid-19 pandemic.

While accommodation and food services peaked at around 25 days late last year, with TPW sitting alongside construction and administrative and support services in the mid-teens, TPW now sits with the latter as well above any other sector.

Some industries have shaved a few days off their average from last month, but when compared to 2019, “the majority have taken a beating”, CreditorWatch notes.

“For all industries except mining, the pressure on cash flow and their ability to pay bills has skyrocketed year-on-year.”

CreditorWatch highlights that recent data paints a stark picture of Australia’s economic landscape.

“With payment times staying stubbornly high, it’s clear that the SME sector is struggling to generate cash flow outside of government support, indicating that there is a mountain of trouble behind the curtain of stability,” CreditorWatch chief economist Harley Dale says.

Trucking bodies have previously pointed to stronger amendments needed to the proposed Payment Times Reporting Scheme (PTRS), as big businesses are accused of boosting cash flows by delaying payments to suppliers.

Under the scheme, big companies and government enterprises will be required to report twice a year on their payment terms for small business suppliers, with those reports made available publicly.

“The approach is welcome, but not strong enough,” Australian Trucking Association (ATA) chair David Smith has noted, whose calls are similar to that of Australian Small Business and Family Enterprise Ombudsman (ASBFEO) Kate Carnell.

Slow payers benefitting from COVID crisis

Carnell says it is “particularly unacceptable” for big entities to use late payments as a method of making their figures look better.

She notes the PTRS is not as tough as it should be because no financial penalties apply to big companies that do not pay small businesses within 30 days.

She says her office will monitor compliance and will push for tougher legislation if payments do not start speeding up.

In the meantime, Carnell recently welcomed federal treasurer Josh Frydenberg’s plans to change lending laws to lift “onerous barriers” to small businesses applying for loans.

ASBFEO has also joined CPA Australia, Chartered Accountants Australia and New Zealand (CAANZ), Institute of Public Accountants (IPA), Institute of Certified Bookkeepers (ICB), Council of Small Business Australia (COSBOA) calling for a government-funded subsidy to ensure small businesses can access urgently needed professional advice on their viability.

Under the jointly proposed Small Business Viability Review program, small businesses with up to $10 million in annual turnover would be eligible to obtain a subsidy valued up to $5,000 to access a tailored 15-month plan from an accredited professional on how and whether to turn around their business or exit.

“Small businesses have endured the toughest trading conditions we’ve seen in living memory over the past few months and the sad reality is that not all of them will survive,” Carnell says.

“Small businesses need access to an accredited professional adviser such as an accountant or bookkeeper to judge the viability of the business now.

“This is the critical first step that the small business owner needs to take so they can make an informed decision about the future of their business.”

A higher-resolution version of the graph is available here.